The Impact of Trump’s Tariffs on Seattle's Housing Market: Prices Set to Rise Even Higher

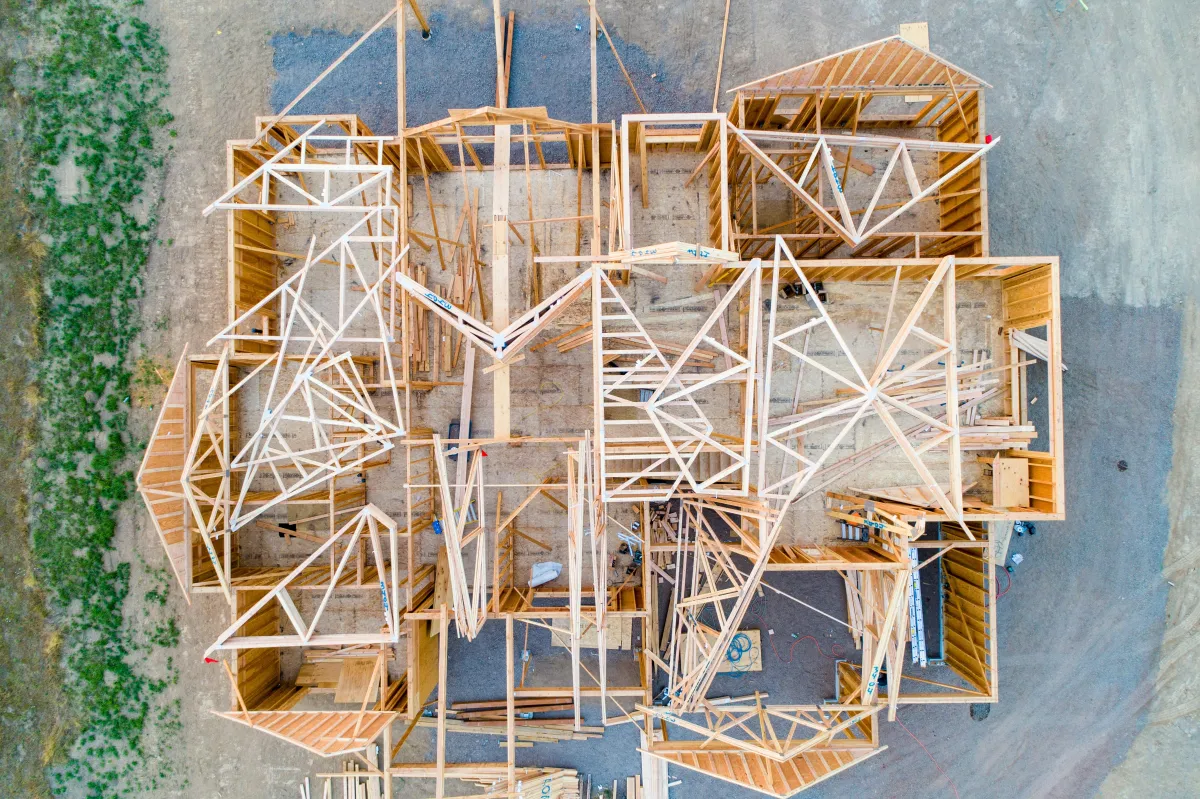

Seattle’s housing market is already one of the most expensive in the country, and with new tariffs on building materials, buyers are facing even more challenges. Homebuilders in the Seattle metro area are preparing for increased costs on imports like softwood lumber, gypsum, and steel—essential materials for home construction. The Trump administration's tariffs on Chinese goods—which doubled from 10% to 20% in February 2025—impact a wide range of construction materials, including electrical supplies. These added costs will inevitably drive up construction expenses and, consequently, home prices.

Tariffs and Rising Costs

On March 4, President Trump’s administration implemented new tariffs, including a 25% duty on imports from Canada and Mexico and an additional 10% tariff on goods from China (U.S. Department of Commerce, 2025). Given that much of the softwood lumber used in Seattle construction originates in Canada and gypsum for drywall often comes from Mexico, these tariffs significantly impact the local housing market.

Industry experts agree that higher material costs will be passed on to buyers. Kurt Wilson, COO of Soundbuilt Homes, stated, “It all gets passed on. Builders face higher costs for materials and labor, and if they want to maintain profit margins or qualify for financing, they have no choice but to increase prices” (Seattle Times, 2025).

Impact on Electrical Materials

Many electrical components, such as wiring and switches, are imported from China. With tariffs in place, Seattle builders face rising costs in an already expensive market. Since electrical work is fundamental to home construction, these price increases will further inflate overall homebuilding costs (National Association of Home Builders, 2025).

The tariffs on Chinese imports are expected to increase electrical material costs by around 10% or more, compounding the expenses already rising due to tariffs on lumber, gypsum, steel, and aluminum. Builders must account for these higher prices on everything from basic wiring to specialized items like electrical panels.

Seattle’s Already Expensive Market

Seattle's home prices were already steep. As of 2023, the average construction cost in the Seattle area ranged from $200 per square foot for starter homes to $700 for luxury properties, well above the national average of $162 per square foot (National Association of Realtors, 2023). With additional tariff-related cost increases, affordability in the city will become an even greater concern.

King County alone needs 17,000 new homes annually for the next two decades to meet demand, according to the Washington State Commerce Department. However, with rising construction costs, the supply-demand gap is expected to widen, further driving up home prices (WA State Commerce Department, 2025).

Challenges for Affordable Housing

One of the biggest concerns about tariffs is their effect on affordable housing. Builders already operate on slim margins for lower-priced homes, and material price increases make it even harder to construct housing that remains within reach for average buyers.

“Since materials are fixed, it reduces the margins we make on more affordable homes,” explains Keane Ng, a Seattle-area condo developer (Puget Sound Business Journal, 2025). In areas like Pierce County, where homebuilding is less profitable, the tariffs could further discourage the development of entry-level housing, exacerbating the region’s affordability crisis.

The Cost of Living and Labor Challenges

Seattle’s high cost of living already drives up wages for construction workers, adding another challenge for builders. The labor shortage in the region has made it difficult to keep costs down, and tariffs further compound these issues. As Wilson notes, “Washington, Oregon, and California are just very difficult places to build,” due to high labor costs and regulatory hurdles (Seattle Times, 2025).

In addition to labor costs, Seattle’s complex permitting and regulatory requirements make building new homes more expensive. Navigating these bureaucratic processes is already time-consuming and costly, and when combined with increased material costs, it’s no surprise that housing affordability continues to decline.

Inflation and Rising Mortgage Rates

Another potential consequence of tariffs is inflation, which could push interest rates higher. If financing costs rise for builders and homebuyers alike, affordability will suffer even more. Higher mortgage rates mean increased monthly payments, further straining first-time homebuyers (Federal Reserve Economic Data, 2025).

Whats happening now is that the instability and chaos is causing investors to leave the market, and consquetnly move their money to bonds. The instability currently is helping lower mortgage rates. But it’s too hard to know if this will last. Plus, its a double edged sword. Falling rates in this manner are too closely aligned with recession.

The combination of these factors—higher construction costs, fewer affordable homes, and rising interest rates—creates a vicious cycle that keeps homeownership out of reach for many Seattle residents. As supply remains constrained and demand stays strong, prices are expected to climb even further.

The Bottom Line

High costs already burden Seattle’s housing market, and the new tariffs on building materials are set to increase home values while restricting new construction and development. Builders will face greater challenges constructing affordable homes, and buyers will see higher prices. For those already struggling with Seattle’s cost of living, homeownership may feel increasingly unattainable.

While state legislation promoting higher-density developments is relieving some pressure, the immediate impact of tariffs will be felt in rising costs and reduced affordability. Prospective buyers in the Seattle metro area should prepare for continued price increases over the national averages. These tariffs make it even more difficult to bridge the gap between supply and demand. And with the zoning and building regulations here in the Seattle Metro area, and Washington State generally - a lot will need to change in order to support the people and families that want to live and work here.

If you’re looking to buy in Seattle, acting sooner rather than later may be wise—prices are only expected to increase from here.

Best,

Justin H Gazabat

Broker | PNW, Seattle, Ballard, East Side

www.JustinGazabat.com

206-424-9497

PS: If anyone in your social or work circles considering a move, just send Me an intro text or email with their best contact info, make sure everyone is CC’d and I’ll take care of the rest! I promise to take great care of them, serve them well, make you look good, plus help them get great results.

Sources:

U.S. Department of Commerce, 2025

Seattle Times, 2025

National Association of Home Builders, 2025

National Association of Realtors, 2023

WA State Commerce Department, 2025

Puget Sound Business Journal, 2025

Federal Reserve Economic Data, 2025

Justin H Gazabat

Justin H. Gazabat

Justin H. Gazabat

Compass is a licensed real estate broker and abides by Equal Housing Opportunity laws. All material presented herein is intended for informational purposes only. Information is compiled from sources deemed reliable but is subject to errors, omissions, changes in price, condition, sale, or withdrawal without notice. No statement is made as to the accuracy of any description. All measurements and square footages are approximate. This is not intended to solicit property already listed. Nothing herein shall be construed as legal, accounting or other professional advice outside the realm of real estate brokerage.