Washington Home Prices Rose 828% in 40 Years: Why Now Is the Time

Washington Home Prices Rose 828% in the last 40 Years: Why You can't ignore making a move.

Washington’s Real Estate Market

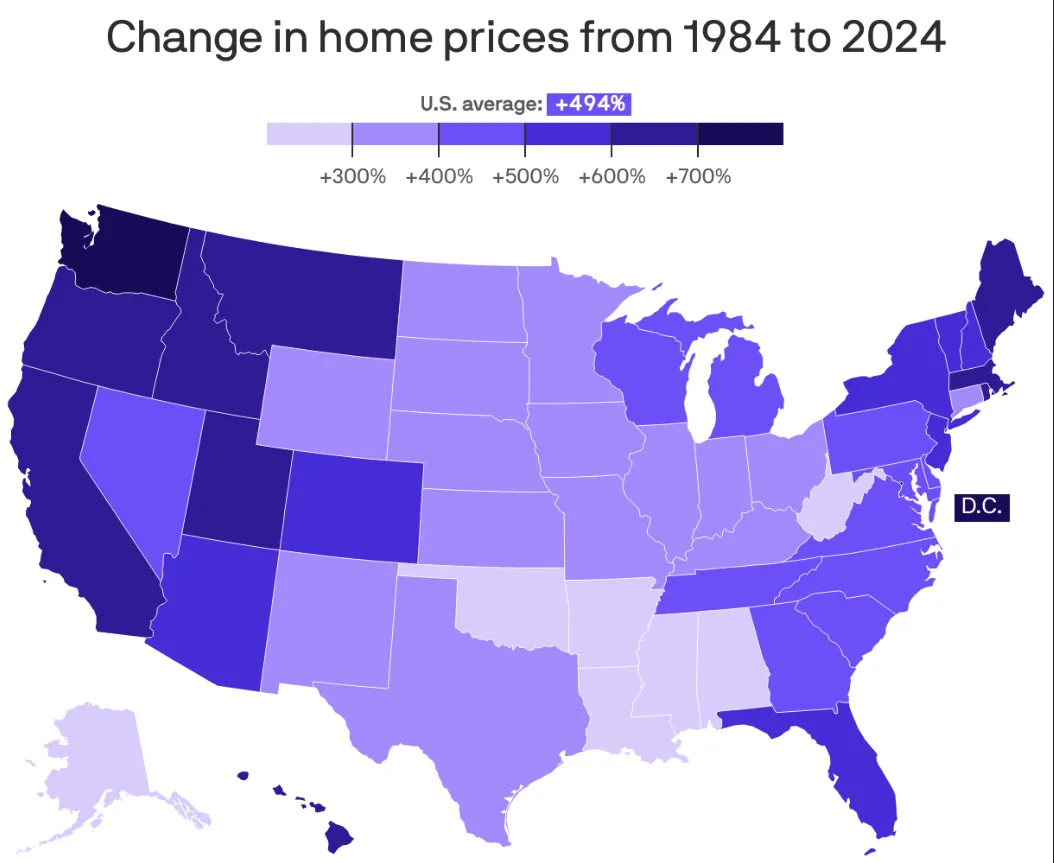

Over the past four decades, Washington home prices have skyrocketed by an astonishing 828%, far outpacing the national average of 494%. While affordability concerns dominate the headlines, these rising prices underscore the undeniable long-term value of owning property in the state—especially in high-demand areas like Seattle.

If you’re hesitating to buy in today’s market, consider these five key reasons why now is the time to invest in real estate and how embracing the concept of stepping stone homes can set you up for long-term wealth:

1. Get in the Game—Don’t Wait on the Sidelines

The data is clear: real estate appreciates significantly over time. Washington’s 828% increase in home prices since 1984 isn’t just a fluke; it’s a pattern fueled by economic growth, limited housing supply, and strong demand.

By purchasing a home today—whether it’s your dream home, a stepping stone home, or even a small starter home—you’re entering the market and positioning yourself to benefit from future appreciation. Waiting for prices to drop or for the market to “cool down” is a gamble most can’t afford to take. Because, if you look at the numbers - the sheer fact that there are not enough homes to meet the demand says we won't see any significant drops in value.

Even if you can’t afford the perfect home in your ideal neighborhood right now, owning something creates an opportunity to build equity. Over time, that equity can help you upgrade or invest further.

2. Diversify Beyond Your Company Stock

Seattle’s tech workers often rely heavily on company stock and RSUs to build wealth, but this creates a dangerous concentration of risk. Scandals, market volatility, or poor quarterly results can erode your financial foundation.

Real estate offers a proven diversification strategy. Unlike stocks, which can fluctuate wildly, home prices tend to appreciate steadily over time. Owning property is a hedge against inflation and a tangible asset that can generate rental income or tax advantages.

It’s worth asking: would you rather rely solely on your employer’s performance or build wealth with an asset that has increased in value by over 800% in 40 years?

3. Affordability Is a Challenge, But That’s Why It’s Worth It

Yes, Washington’s housing market is tough. Nearly 73% of households can’t afford a median-priced home ($640,000 in the state), and Seattle’s median price of $875,000 feels insurmountable for many. But here’s the thing: anything worth doing is often hard.

Purchasing a home today may stretch your finances, but the payoff comes in the form of stability, equity, and the ability to weather future market changes. Obviously, you don't want to buy something you can't afford - but what if you stopped buying starbucks, quite Netflix, Hulu, Youtube Premium, and Amazon Prime. Surely giving up some modern convenances if it means owning your own home would be worth it. (continue reading to see the real math you can't ignore).

As a homeowner, you’re no longer at the mercy of rising rents or limited housing options. Instead, you’re investing in yourself and securing a foothold in a market that continues to grow.

4. Leverage Exponentially Boosts Your Returns: Math You can't Ignore

One of the most overlooked advantages of real estate is the power of leverage. Unlike stocks, where you typically need to invest the full amount upfront, purchasing a home only requires a down payment—often just 5%, 15%, or 20% of the property’s total value.

Here’s why that matters:

While Washington home prices have risen 828% over the last 40 years, homeowners didn’t pay the entire cost of their property in cash to see that gain. Instead, they leveraged their purchase with a down payment and a mortgage, meaning their cash-on-cash return (the return on the money they actually invested) is exponentially higher than the property’s appreciation.

For example:

If you bought a $100,000 home in 1984 with a 20% down payment ($20,000), and the home is now worth $828,000, your initial investment grew 41x, not just 8.28x.

To look at it another way: If you purchased a $100,000 home in 1984 with a 20% down payment ($20,000), your cash-on-cash return would be an astonishing 3,640% over 40 years. This highlights the immense power of leverage in real estate investments.

That’s the kind of return that no other investment—certainly not company stock—can reliably provide while also giving you a place to live.

This is why entering the market is so crucial. Its not about timing the market, it's about Time IN the market. Even if home prices feel high, the combination of long-term appreciation and leverage means the sooner you buy, the more opportunity you have to grow your wealth.

5. Real Estate vs. Stocks: The Leverage Multiplier

While financial experts often highlight the stock market's impressive long-term growth compared to real estate, the conversation frequently overlooks a critical factor: leverage. Unlike stocks, which require you to invest the full amount upfront, real estate allows you to control a significant asset with a fraction of its cost through a down payment. This difference dramatically amplifies your cash-on-cash returns.

According to a recent popular CNBC Make It article, the S&P 500 they highlight how the has grown by 1,325% between 1990 and 2024. Compared to a 308% rise in national home values during the same period, as measured by the Case-Shiller U.S. National Home Price Index. While this article highlights a different timeline (only 304 years as compared to 40), it also favors stocks in raw growth, it overlooks a critical factor: leverage.

Real estate uniquely allows you to control a valuable asset with a fraction of its cost through a down payment. This amplifies cash-on-cash returns in ways stocks absolutely cannot replicate. Especially when you look specifically at Washington State and Seattle vs national averages.

For example:

The CNBC Make It article examined national home value appreciation, finding a 308% national average in increased value. On the surface, stocks outperform real estate in terms of raw appreciation.

But consider the leverage in real estate. If you had purchased a $100,000 home in 1990 with a 20% down payment ($20,000), that property’s value would have risen to $408,000 by 2024. This growth represents a 1,900% return on your initial investment, compared to the S&P 500’s 1,325% during the same timeframe.

Leverage is the key that turns modest appreciation into exponential returns in real estate. This isn’t just theory—it’s why real estate has been a cornerstone for wealth-building across generations.

Acknowledging the Scope of Comparison

It’s important to clarify that this analysis is referencing two distinct perspectives. The CNBC Make It article evaluates national home value appreciation using the Case-Shiller Index and assumes no leverage, while our broader discussion focuses on cash-on-cash returns, factoring in real estate's leverage and the tangible benefits of homeownership.

By comparison, our original analysis spans a 40-year period, emphasizing how regional markets—like those in the Puget Sound area—can significantly outperform the national average. For instance, while national home appreciation from 1990-2024 averaged 308%, many localized markets have seen far higher growth due to regional demand, economic trends, and limited inventory. I wish the CNBC article would have done a 40 year span so we could better compare apples to apples.

Real Estate’s Stability vs. Stocks’ Volatility

Stocks undeniably deliver robust long-term returns, but they come with higher short-term volatility. By contrast, real estate offers a hedge against inflation, stable growth, and the added benefits of housing stability, tax advantages, and potential rental income.

For many Americans, real estate represents more than an investment. It’s a diversified wealth-building tool that combines financial growth with lifestyle benefits and a stepping stone to financial independence.

The CNBC Make It article underscores the power of stocks, but when you factor in leverage and the practical benefits of real estate, the equation shifts dramatically. Over time, real estate remains a vital component of wealth-building, with the potential for exponential returns.

Why Stepping Stone Homes Are the Solution

Many buyers get caught up in the idea of finding their “forever home” right out of the gate. But in a high-cost market like Seattle, starting small can be the smartest move.

Stepping stone homes allow you to:

Enter the market at a more affordable price point.

Build equity over time to leverage for future upgrades.

Avoid the risk of overextending yourself financially.

Instead of waiting for the perfect scenario, focus on what you can afford today. A townhouse, a condo, or even a modest single-family home could be your ticket to long-term wealth.

The Bottom Line

Don't put your home ownership dreams on hold. Yes, home prices are high, and affordability is a challenge. But history shows us that real estate in Washington appreciates at rates that few other investments can match. By purchasing a stepping stone home today, you’re not just buying a place to live—you’re securing your financial future.

The sooner you get in the game, the sooner you can start building equity, diversifying your investments, and taking advantage of the incredible wealth-building opportunities that real estate offers.

Let’s Create a Plan That Works for You

Let’s chat about how to turn today’s market challenges into your financial advantage. Together, we’ll create a plan tailored to your goals and set you on the path to long-term wealth.

Best,

Justin H Gazabat

Broker | PNW, Seattle, Ballard, East Side

Your Friendly Seattle Neighborhood Real Estate Professional.

www.JustinGazabat.com

PS: If anyone in your social or work circles considering a move, just send Me an intro text or email with their best contact info, make sure everyone is CC’d and I’ll take care of the rest! I promise to take great care of them, serve them well, make you look good, plus help them get great results.

Information from our friends at: Freddie Mac, Lance Lambert of ResiClub, Building Industry Association of Washington (BIAW), Washington state dept. commerce, Redfin Data, and this Article from Christine Clarridge at Axios.

Justin H Gazabat

Justin H. Gazabat

Justin H. Gazabat

Compass is a licensed real estate broker and abides by Equal Housing Opportunity laws. All material presented herein is intended for informational purposes only. Information is compiled from sources deemed reliable but is subject to errors, omissions, changes in price, condition, sale, or withdrawal without notice. No statement is made as to the accuracy of any description. All measurements and square footages are approximate. This is not intended to solicit property already listed. Nothing herein shall be construed as legal, accounting or other professional advice outside the realm of real estate brokerage.